The only mileage tracker that lets you choose exactly how your data is stored. Track every deductible mile automatically, with privacy controls no other app offers. From fully local to cloud-synced — you decide.

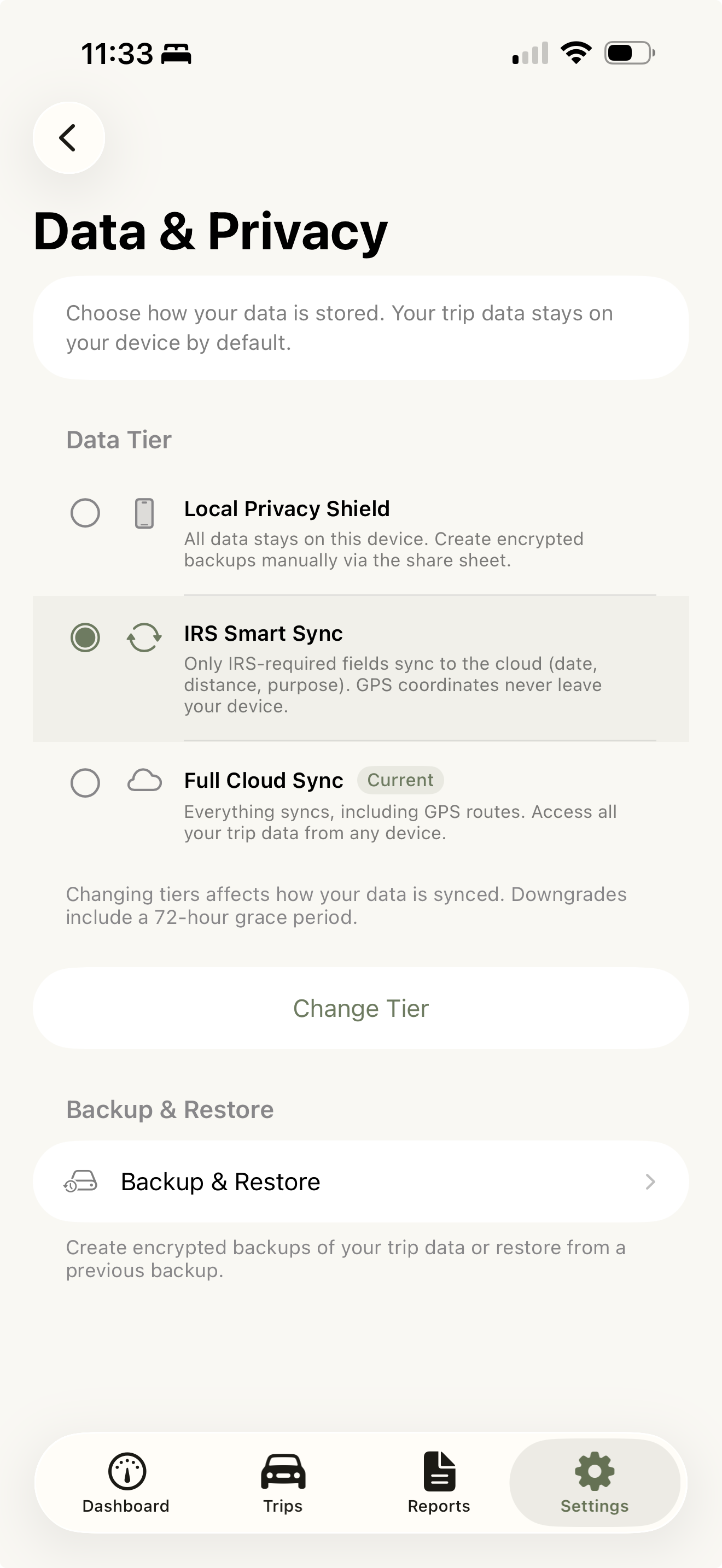

No other mileage app gives you this choice. Pick the privacy level that fits your comfort, and change it anytime.

All data stays on your device. Create encrypted backups manually and store them wherever you trust — your hard drive, your USB stick, your rules. Nothing is ever uploaded.

Only the three fields the IRS requires — date, distance, and purpose — sync to the cloud. Your GPS coordinates never leave your device. Smart backup without surveillance.

Everything syncs securely, including GPS routes. Access all your trip data from any device. Valley Technologies Group will never sell your data to third parties — full convenience with full respect.

Every tier includes encrypted backups. Every tier keeps you in control.

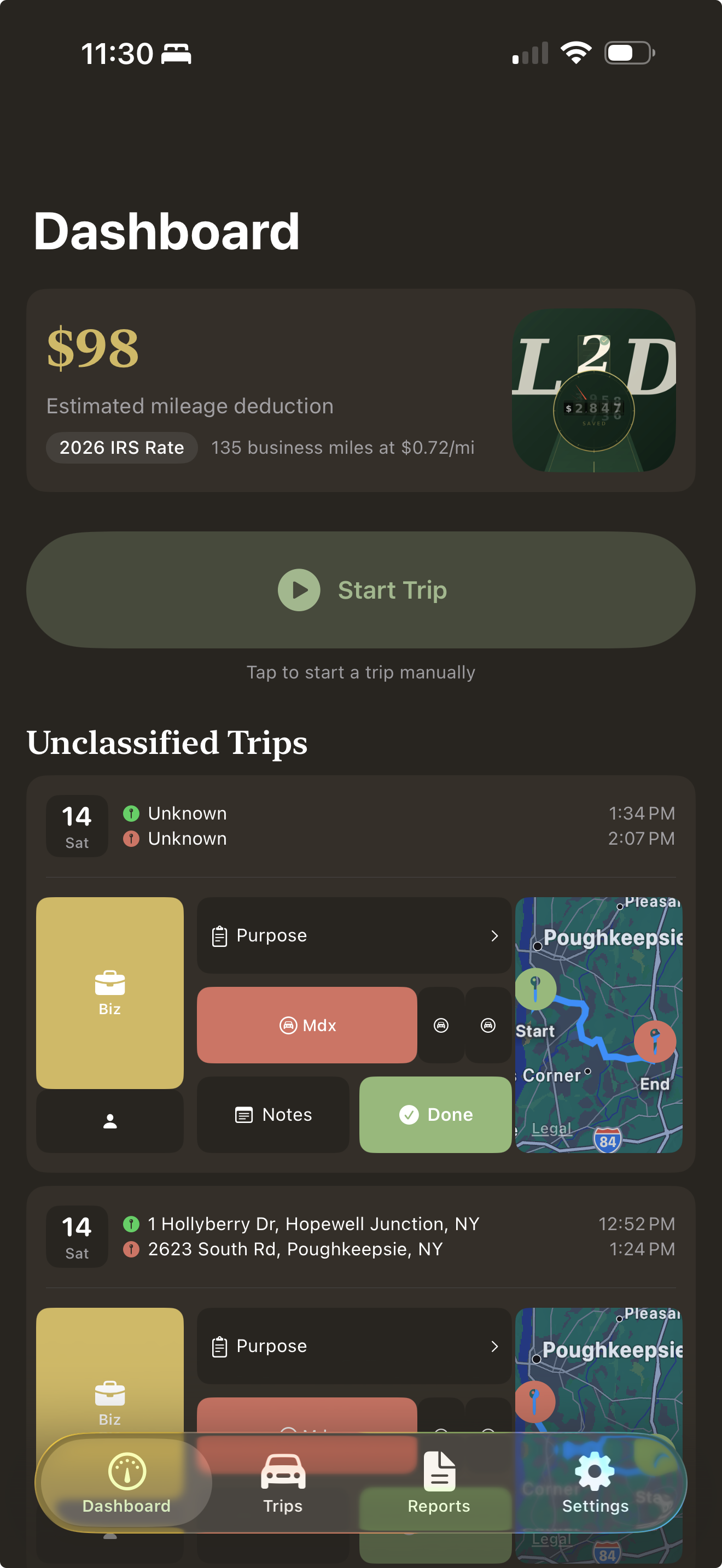

Every feature is designed to save you time, maximize your tax deductions, and keep your data under your control.

Your phone detects when you start driving and logs every mile in the background. No buttons to press, no apps to open.

Learns your routes over time and suggests whether a trip is business or personal. Classify with a single swipe.

Generate mileage logs that meet IRS requirements for Schedule C deductions. Export as PDF or CSV anytime.

Your trip data stays on your device by default. Choose from three privacy tiers — from fully local to cloud-synced — and change anytime.

Full offline capability means trips are tracked even in areas with no cell coverage. Data syncs when you reconnect.

When April arrives, your mileage log is already complete. Export your full year of trips in seconds, not hours.

No complex setup, no manual entry. Just download, choose your privacy level, drive, and deduct.

Free on iOS and coming soon to Android. Create your account in 30 seconds.

Pick from Local, IRS Smart Sync, or Full Cloud. You can change anytime.

The app runs in the background and automatically detects every trip.

Download your IRS-ready mileage report and claim your deduction.

The average self-employed professional drives thousands of deductible miles each year. Are you tracking yours?

Everything you need to know about mileage deductions and how License to Deduct works.

If you are self-employed or a freelancer who files Schedule C, you can deduct business miles driven. This includes rideshare drivers, delivery drivers, real estate agents, photographers, consultants, and any independent contractor who uses their vehicle for work.

License to Deduct uses your phone's motion sensors and GPS to detect when you start and stop driving. Trips are recorded automatically in the background with minimal battery impact. You can also start trips manually if you prefer.

You choose how your data is stored. Local Privacy Shield keeps everything on your device. IRS Smart Sync uploads only the three fields the IRS requires (date, distance, purpose) — GPS coordinates never leave your phone. Full Cloud Sync backs up everything for cross-device access. You can switch tiers anytime.

Never. Valley Technologies Group, the maker of License to Deduct, will never sell, share, or monetize your location data or trip history with any third party. Your driving data exists to serve you — not advertisers.

No. We use efficient location services that run in the background with minimal battery impact. Most users report less than 5% additional battery usage per day, even with full-time tracking enabled.

You can export a complete IRS-compliant mileage log as a PDF or CSV file. Reports include date, destination, business purpose, and miles driven for each trip — exactly what the IRS requires for Schedule C mileage deductions.

Every untracked mile is money left on the table. Download License to Deduct, choose your privacy level, and claim what you have earned.